Key performance review

MEASURING OUR PROGRESS

- FINANCIAL

- SEGMENTAL

- ENVIRONMENTAL

- SOCIAL

- GOVERNANCE

FINANCIAL

REVENUE FROM OPERATIONS

(INR CRORES)

- FY 21-2212,425

- FY 20-2111,602

- FY 19-209,637

7% (9%*)

increase

EBITDA

(INR CRORES)

- FY 21-221,749

- FY 20-211,569

- FY 19-201,310

11%

increase

PROFIT BEFORE TAX AND EXCEPTIONAL ITEMS

(INR CRORES)

- FY 21-221,508

- FY 20-211,342

- FY 19-201,084

12%

increase

GROUP NET PROFIT

(INR CRORES)

- FY 21-221,015

- FY 20-21930

- FY 19-20460

9%

increase

RETURN ON CAPITAL EMPLOYED

(ROCE) (%)

- FY 21-2232.8

- FY 20-2134.7

- FY 19-2026.2

SEGMENTAL

INDIA BUSINESS

(INR CRORES)

- FY 21-227,914

- FY 20-217,003

- FY 19-205,402

13%

increase

INTERNATIONAL BEVERAGES

(INR CRORES)

- FY 21-223,336

- FY 20-213,508

- FY 19-203,226

-5% (1%*)

increase

NON-BRANDED BUSINESS

(INR CRORES)

- FY 21-221,214

- FY 20-211,122

- FY 19-20975

8%

increase

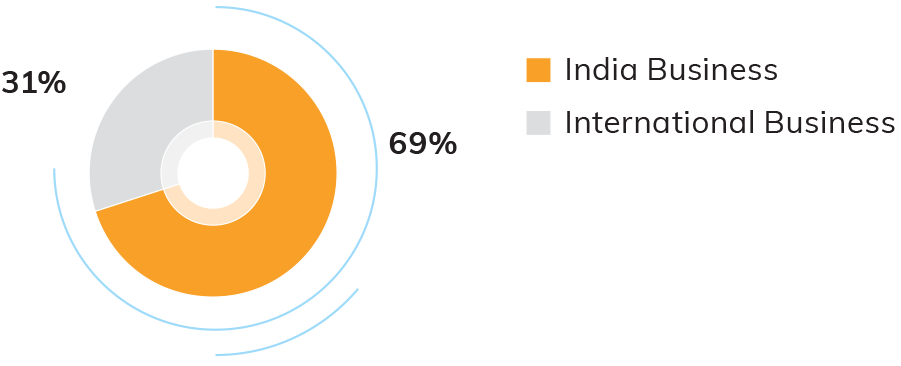

REVENUE – BRANDED BUSINESS IN FY 21-22

SEGMENT RESULTS-BRANDED BUSINESS

ENVIRONMENTAL

GHG EMISSIONS

(MTCO2e)

- FY 21-2212,61023,015

- FY 20-2113,25919,083

- FY 19-2011,73116,869

The increase in GHG emissions between FY 19-20 to FY 21-22 is because of the integration of the Foods business and addition of a new location to the operational boundary.

*Assurance underway

RENEWABLE ENERGY

(%)

- FY 21-2224.0

- FY 20-2125.8

- FY 19-2014.1

100%

EPR compliance in India. All our Beverages production facilities globally are zero waste to landfill since 2019

150 MILLION LITRES

Of water recharged through Project Jalodari. It will contribute to same amount of recharge annually going forward

FOUNDING MEMBER

Of the India Plastics Pact

SOCIAL

TOTAL LEARNING HOURS

(HOURS)

- FY 21-2223,360

- FY 20-2133,511

- FY 19-2014,157

INVESTMENTS IN CSR PROGRAMMES

(INR CRORES)

- FY 21-2213.5

- FY 20-2112.0

- FY 19-2010.9

- Zero investor complaints as on 31 March 2022

- 8,500+ volunteering hours with the help of 3,500+ volunteers in FY 21-22

GOVERNANCE

- 55% Independent Directors on Board as on 4 May 2022

- 96% Board attendance during FY 21-22

- 100% attendance of committee meetings during FY 21-22